Capital gain formula real estate

Parish Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate. Net Sale of the Property including Acquisition Costs Net Purchase Price including Investments in Capital Improvements.

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

In order to calculate short term capital gains the computation is as below.

. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. More help with capital gains calculations. The return on capital gain is the measure of the.

Find top Saint Amant LA Real Estate attorneys near you. Formula for Calculation of Short Term Capital Gains. Let us take it as a simple number say Rs.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household. Short Term Capital Gain Final Sale Price. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

Capital gains are profits from the sale of a capital asset such as stocks bonds or real estate. 500000 of capital gains on real estate if youre married and filing jointly. The capital gains tax is a tax on these profits.

Zillow has 2193 homes for sale in New Orleans LA. Compare detailed profiles including free consultation options locations contact information awards and education. The formula should look something like this.

For example if you sold the house for 930000 but paid the real estate agent 20000 and paid 5000 in legal fees your net proceeds are only 905000. Your tax rate is 20 on long-term capital gains if youre a single filer earning more than 445851 married filing jointly earning more than 501601 or head of household earning. You only have to pay capital gains taxes if you.

The IRS typically allows you to exclude up to. 250000 of capital gains on real estate if youre single. Note down the purchase price of your real estate investment.

Return On Capital Gains. Let us first calculate the capital gains made on on your real estate investment. Gains on the sale of collectibles rental real estate income collectibles antiques works of art and stamps are taxed at a maximum rate of 28.

The return that one gets from an increase in the value of a capital asset investment or real estate.

Capital Gains Yield Cgy Formula Calculation Example And Guide

Flipping Houses Taxes Capital Gains Vs Ordinary Income

3 Ways To Calculate Capital Gains Wikihow

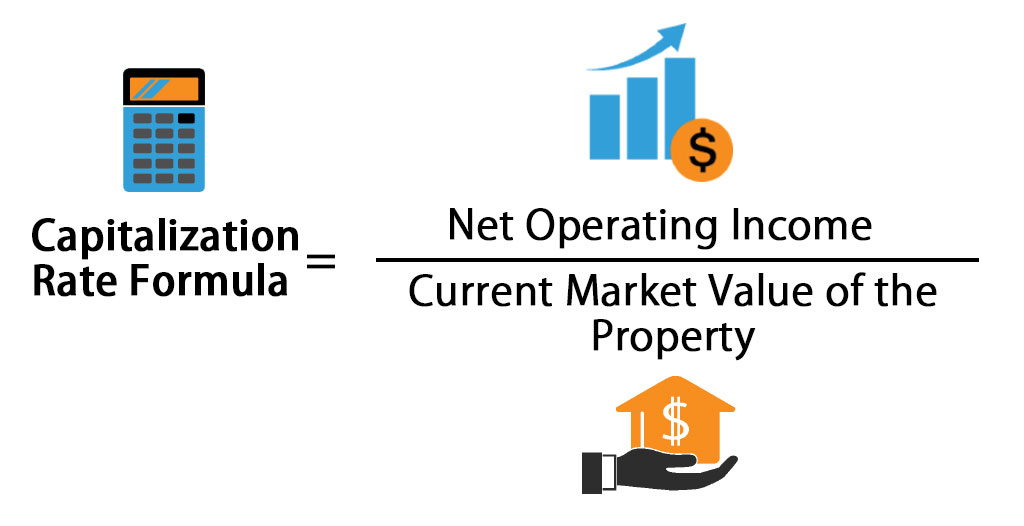

Capitalization Rate Formula Calculator Excel Template

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

How To Calculate Capital Gains Tax H R Block

Capital Gains Tax What Is It When Do You Pay It

3 Ways To Calculate Capital Gains Wikihow

3 Ways To Calculate Capital Gains Wikihow

3 Ways To Calculate Capital Gains Wikihow

Capital Gains Tax What Is It When Do You Pay It

How To Save Capital Gain Tax On Sale Of Residential Property

Capital Gains Tax 101

Capital Appreciation Meaning Example How To Calculate

3 Ways To Calculate Capital Gains Wikihow

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

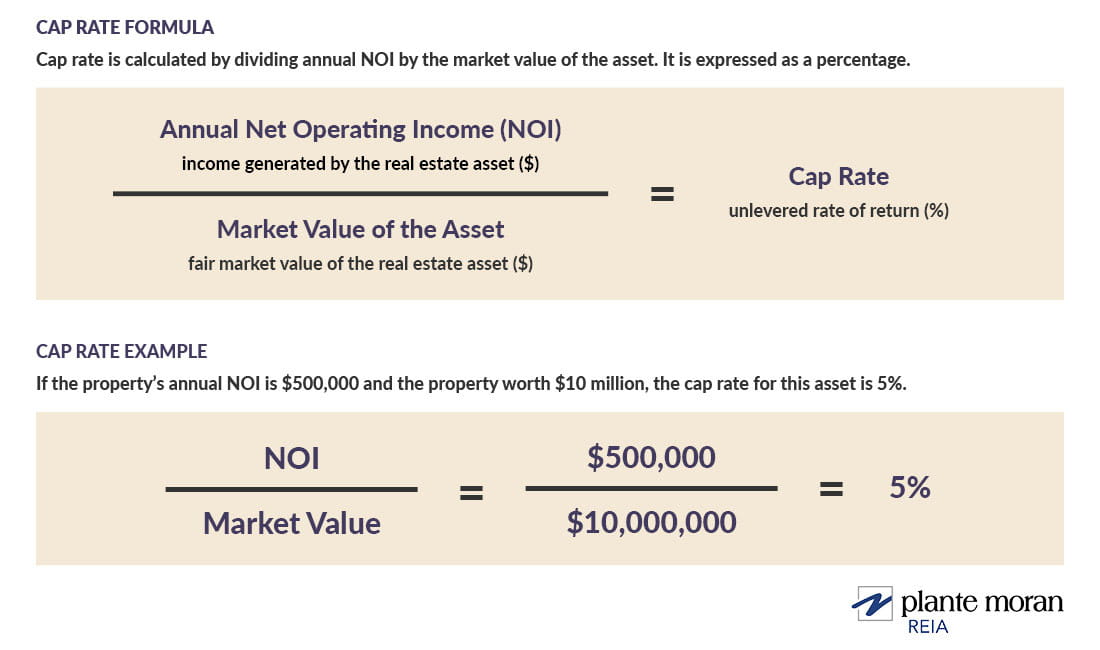

Return Metrics Explained What Is A Cap Rate In Commercial Real Estate Our Insights Plante Moran